Taxes by TIN are now in force for everyone

Due to the large number of different paymentreceipts people can not figure out exactly what and where to pay. The Federal Tax Service provided this fact and provided an opportunity for all individuals and legal entities to look at their unpaid taxes by TIN. All information is provided online, you just need to go to a special site and enter your personal TIN. This is a very convenient service that simplifies the search for your own tax debts, eliminates the need to defend queues and insult tax inspection thresholds. The main thing is to have access to the Internet.

- Full Name;

- individual number of the taxpayer;

- region of residence.

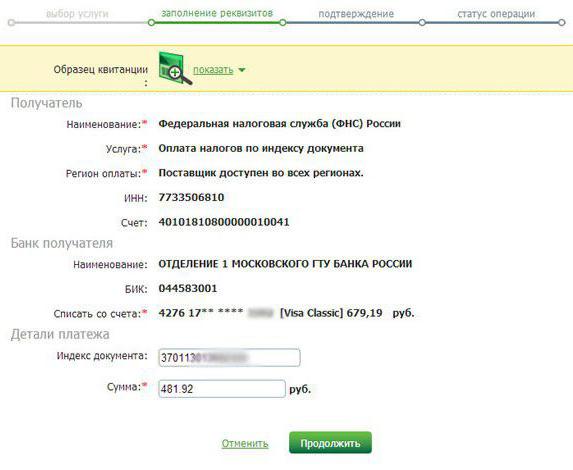

After the personal office is created, you canget all information on taxes. If an individual has debts, then the amount to be paid will be displayed in the special window. Moreover, the program allows you to create a payment order, which is a receipt, from which you must apply to the bank for payment. That's how you can find out tax on TIN, and immediately generate a payment document. The program is very easy to use, so even the most inexperienced PC user can easily cope with this task.

Knowing your taxes by TIN is very important, becausesignificant delays lead to various troubles: the penalty is charged daily, accounts are blocked, travel abroad is prohibited. Such problems are not needed by anyone, so they can be avoided if all pay in time.

After all taxes by INN are recognized,you can make a payment, including penalties and fines. Payment is possible by bank transfer or by cash. In the first case, the system offers to pay using bank accounts and payment terminals. However, the banks are not all listed, but among the most popular are Sberbank and Promsvyazbank.